challenge

Maria who lives in Austin, Texas wants to send $100 to her father in Mexico City to pay for groceries. Her concerns are the following:

$1000 minimum. Her father needs a bank account

Instant transfer charges plus $3.99 < $500

$5 minimum plus exchange rate and markup

$3 flat fee for amounts less than $300.

Quick delivery but the high exchange rate

research

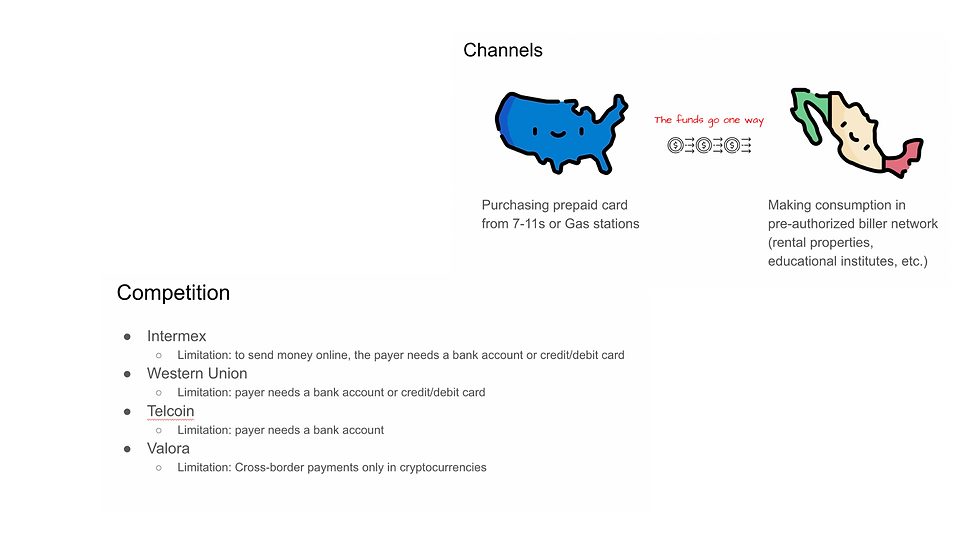

After probing the challenge, we deep-dived into gathering data. It was important to assess the competitive landscape and the channels that will be used to make the experience seamless for the customers.

our solution

For Mexican migrant workers in the USA who want to contribute towards their family’s mortgage, rent, tuition, and grocery bill payments back in Mexico, we offer a mobile money account for the purpose of remittance payments that doesn’t require a bank account and can be funded through cash transactions. Unlike traditional money transfer services, our service charges lower fees since non-cash payments to a pre-authorized network of trusted billers reduces the burden of KYC, AML, and CFT checks.

continuing to build

There are around 150,000 convenience stores in the USA. To capture our early adopters, we will be partnered with 7-elevens, Alimentation Couche-Tard, Speedways, and Casey`s, which make up 22745 outlets in the USA.

Keeping in mind the historical data, our beachhead will be the states of California, Texas and Illinois.

We also plan to grow our market reach and further advance our offerings by introducing a mobile app following the current model. The app will also focus on this underserved customer segment who want to send small tickets to families at the most affordable price.

what we learnt

we received positive feedback on our concept validation. One of the leading fintech startup founders in Vancouver said and I quote

"This was my favourite idea of the day. It’s actually a very simple iteration on a business model that could potentially deliver incredible business and financial inclusion value. It is also very feasible - I can think of multiple ways to implement this while avoiding some of the largest hurdles facing fintech. There is a strong parallel to the Tyme Bank model in terms of creating a win-win-win for you, the store partners (foot traffic, deposits, revenue) and the users. I loved that you tried to not overcomplicate the tech - perfect."